02 Dec Present Value Of An Ordinary Annuity Table

Content

- How Do You Calculate Present Value In Excel?

- Other Methods For Calculating The Present Value Of An Annuity

- Understanding Present Value Of An Annuity

- Checking Your Browser Before Accessing Financialmentor Com

- Appendix: Present Value Tables

- Present Value Of Annuity, Future Value Of Annuity, And The Annuity Table

- About Present Value Of Annuity Calculator

Using the annuity table, you can see what the present value of the annuity is. If it is less than the lump sum offered, taking the lump sum and investing it is probably the better option. An ordinary annuity makes payments at the end of each time period, while an annuity due makes them at the beginning. All else being equal, the annuity due will be worth more in the present. A whole life annuity due requires annuity payments at the beginning of each monthly, quarterly, or annual period, as opposed to at the end of the period. Calculate the present value interest factor of an annuity and create a table of PVIFA values. Create a printable compound interest table for the present value of an ordinary annuity or present value of an annuity due for payments of $1.

The future value refers to the total of all payments of the future values in the annuity. Therefore, it explains that it is possible to add up all future value of cash flows but not pragmatic if more than a couple of payments are there. This can be accomplished by considering the future and the present value. They receive the loan amount called the principal now and are obligated to pay back the principal in the future over a stated amount of time , as regular periodic payments with interest. If Mr. Cash accepts P dollars, then the P dollars deposited at 8% for 20 years should yield the same amount as the $1,000 monthly payments for 20 years. In other words, we are comparing the future values for both Mr. Cash and Mr. Credit, and we would like the future values to equal.

Despite this, present value tables remain popular in academic settings because they are easy to incorporate into a textbook. Because of their widespread use, we will use present value tables for solving our examples. Using basic information about your annuity, an annuity table can help you find out the present value of your annuity. Make sure you’re using the right table for the type of annuity you have. Annuities can help you plan for your retirement by providing a guaranteed source of income for you and your family when you reach your golden years.

How Do You Calculate Present Value In Excel?

At the end of the 10-year period, the $10,000 lump sum would be worth more than the sum of the annual payments, even if invested at the same interest rate. An annuity table calculates the present value of an annuity using a formula that applies a discount rate to future payments. A common example of an annuity is a retirement plan where the investor purchased the annuity and at a point in the future, the retirement fund pays the investor a set amount each month. There are ordinary annuities where payments occur at the end of the period and present value of an annuity due or PVAD where the payments occur at the beginning of the period. The Excel FV function is a financial function that returns the future value of an investment. Similar to discussed for present value, the future value of annuity due table is higher than ordinary annuity by the similar factor of ( 1+i ) periodic interest rate.

What is an annuity due?

Annuity due is an annuity whose payment is due immediately at the beginning of each period. Annuity due can be contrasted with an ordinary annuity where payments are made at the end of each period. A common example of an annuity due payment is rent paid at the beginning of each month.

This is done by using an interest rate to discount the amount of the annuity. The interest rate can be based on the current amount being obtained through other investments, the corporate cost of capital, or some other measure.

Other Methods For Calculating The Present Value Of An Annuity

Closely related to the net present value is the internal rate of return , calculated by setting the net present value to 0, then calculating the discount rate that would return that result. If the IRR ≥ required rate of return, then the project is worth investing in.

Therefore, $285.94 refers to the current value of $100 for three payments with a rate of 5%. XYZ International paid a third party $100 at the start of each year for the upcoming three years for rights to a key patent. Therefore, Find the cost to XYZ, if it has to pay the whole amount with an interest rate of 5%. As discussed above, insurance expenses as also annuities due as the insurer gets paid at the start of the coverage period.

Understanding Present Value Of An Annuity

Moreover, If a person is making regular payments on a loan, the future value helps in determining the total cost of the loan. In this case we want to put a lump sum into the savings account now, so that lump sum is our principal, \(\mathrm\).

Also, In the annuity due table, each period discounts one period less concerning a similar ordinary annuity. Concerning the future value, the present value explains the amount of money required now to occur in a series of payments in the future, assuming a fixed interest rate. However, the future and the present value formulas differ slightly from ordinary annuity because of the differences in when the payments are made. For example, a car loan can be an annuity where the company gives the person a loan to purchase a car. However, the individual makes an initial down payment and then each month a fixed amount.

Checking Your Browser Before Accessing Financialmentor Com

It is the most basic account that banks, credit unions, and small lenders offer. For help with annuities, hire a financial advisor to make sure you’re taking the right steps for your retirement. Find an advisor with SmartAsset’s free financial advisor matching service.

- You might want to calculate the present value of the annuity, to see how much it is worth today.

- An annuity table calculates the present value of an annuity using a formula that applies a discount rate to future payments.

- It is important to investors as they can use it to estimate how much an investment made today will be worth in the future.

- However, the annuity due table is different for present and future value considering the time value and value of the investment.

- Talk to your advisor or annuity company to make sure you are using the correct table.

- His background in tax accounting has served as a solid base supporting his current book of business.

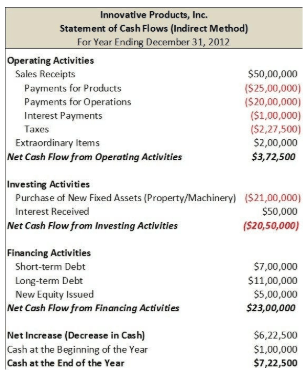

If the NPV is positive, then the investment is considered worthwhile. The NPV can also be calculated for a number of investments to see which investment yields the greatest return. In corporate finance, a discount rate is the rate of return used to discount future cash flows back to their present value. This rate is often a company’s Weighted Average Cost of Capital , required rate of return, or the hurdle rate that investors expect to earn relative to the risk of the investment. If you don’t have access to an electronic financial calculator or software, an easy way to calculate present value amounts is to use present value tables . PV tables cannot provide the same level of accuracy as financial calculators or computer software because they use factors that are rounded off to fewer decimal places. In addition, they usually contain a limited number of choices for interest rates and time periods.

Appendix: Present Value Tables

There is an expression that “time is money.” In capital budgeting, this concept is actually measured and brought to bear on the decision process. The fundamental idea is that a dollar received today is worth more than a dollar to be received in the future. This result occurs because a dollar in hand today can be invested to generate additional immediate returns. Present value of an annuity of $1 table is used to find the present value of a series or stream of equal cash flows beginning at the end of the current period and continuing into the future. When we compute the present value of annuity formula, they are both actually the same based on the time value of money.

Future Value of an Annuity Definition – Investopedia

Future Value of an Annuity Definition.

Posted: Sat, 25 Mar 2017 22:55:46 GMT [source]

Typically, people use a PV calculator to compute these numbers, but they can also use a present value table. These pv of annuity table charts compute the discount rates used in the PV calculation, so you don’t have to use a complicated equation.

Present Value Of Annuity, Future Value Of Annuity, And The Annuity Table

Although the total cash returns are the same, the time value of money is better for Alpha than Beta. With Alpha, the money is returned sooner, allowing for enhanced reinvestment opportunities. Of course, very few capital expenditure choices are as clear cut as Alpha and Beta. Therefore, accountants rely on precise mathematical techniques to quantify the time value of money. However, the benefit from ordinary annuity gains by holding the money for longer . Conversely, annuity due benefits if the annuitant wants to receive the money sooner.

The cookie is used in context with transactions on the website.x-cdnThis cookie is set by PayPal. Hence, if you pay at the beginning of each year instead of at the end, you will have $24,159.95 more for your retirement. Payment is entered as a negative value, since you are paying that amount, not receiving it. From this potentially long series, a present value formula can be derived. There are opportunity costs to not receiving the money today, such as any potential interest you could earn over the two years.

Be sure to note the striking difference between the accumulated total under an annuity due versus an ordinary annuity ($33,578 vs. $30,526). Let’s calculate how much interest Tim will actually be paying with the balloon loan. The loan is a ten-year note, so we need to figure out what the present value of a $150,000 lump sum is ten years from now. If you want to calculated semi-annual interest, you’ll need to divide these numbers in half. You’ll also learn how to troubleshoot, trace errors, and fix problems.

Keen investors can compare the amount paid for points and the discounted future interest payments to find out. In the example shown, we have a 3-year bond with a face value of $1,000. The coupon rate is 7% so the bond will pay 7% of the $1,000 face value in interest every year, or $70. However, because interest is paid semiannually in two equal payments,… This explains that when the present value of ordinary annuity multiples with (1+i ), it shifts the cash flow to one period back towards time zero. Considering the above example, the concept of the time value of money tells that any sum has more worth as compared to the future like the first $1000 payment is more than the second and so on. Therefore, as the example states $1000 has been invested every year with 5% interest for the next five years.

That factor is then multiplied by the dollar amount of the annuity payment to arrive at the present value of the ordinary annuity. The present value annuity factor is based on the time value of money. The time value of money is a concept where waiting to receive a dollar in the future is worth less than a dollar today, since a dollar today could be invested and be worth more in the future. Because of this, we need a way to compute the present value of future cash flows. The present value annuity factor is used for simplifying the process of calculating the present value of an annuity.

Therefore the table helps the annuitant to take decisions while planning to invest. Moreover, we need to get a brief of annuity and its kind first leading to annuity due table. Finally, we note that many finite mathematics and finance books develop the formula for the present value of an annuity differently. Example \(\PageIndex\) examines how to calculate the loan payment, using reasoning similar to Example \(\PageIndex\).

- Using the annuity table, you can see what the present value of the annuity is.

- The rate of return is the estimated annual interest rate that will be received in the future.

- Investopedia does not include all offers available in the marketplace.

- That means they know all the ins and outs to help get you the financial peace of mind you need.

- With an annuity-due the payments are made at the beginning rather than the end of the period.

The annuity due table includes rent and smartphone bills while ordinary annuity quotes mortgage, loan, dividend and bond interest. However these two methods are not similar to the financial product known as an annuity, but they are related. Therefore, the monthly bills like car payments, mortgages, cell phone payments and rent, are few examples since the beneficiary needs to pay at the start of the billing period. Predictable payments and returning the amount in smaller multiple periods is advantageous for an individual overpaying the whole lot at once. The authors of this book believe that it is easier to use formula \ref at the top of this page and solve for \(\mathrm\) or \(m\) as needed. In this approach there are fewer formulas to understand, and many students find it easier to learn. In the problems the rest of this chapter, when a problem requires the calculation of the present value of an annuity, formula \ref will be used.

Each has a different level of effort and required mathematical skill. Using either of the two formulas below will provide you with the same result. Conversely, if I hand you $1,000 in cash at the end of the year, you will have $1,000.

- There are different FV calculations for annuities due and ordinary annuities because of when the first and last payments occur.

- These functions can be used to compute the value of either an ordinary annuity or an annuity due.

- The present value annuity factor is used to calculate the present value of future one dollar cash flows.

- Calculate the present value interest factor of an annuity and create a table of PVIFA values.

- Against the annuity payment A, or by using a graphing calculator, and graphing the value of the annuity payment as a function of interest for a given present value.

The cash flow from one period is simply the amount of money that is received on a future date. The rate of return is the estimated annual interest rate that will be received in the future. The number of periods is simply the number of times the interest will compound over time. Time value of money is the concept that a dollar received at a future date is worth less than if the same amount is received today. An amount received today can be invested towards future earnings or receive sooner utility. For this particular formula, the present value of one dollar periodic cash flows is to be used for simplifying the calculation of payments larger than one dollar.

The table considers how much money you have put into the annuity and how long it has been invested. Future value is the value of a current asset at a future date based on an assumed rate of growth. It is important to investors as they can use it to estimate how much an investment made today will be worth in the future. This would aid them in making sound investment decisions based on their anticipated needs. However, external economic factors, such as inflation, can adversely affect the future value of the asset by eroding its value. Because of the time value of money, money received today is worth more than the same amount of money in the future because it can be invested in the meantime. By the same logic, $5,000 received today is worth more than the same amount spread over five annual installments of $1,000 each.

Author: Emmett Gienapp

No Comments